Stocks: Tailwinds Building Into The Summer

May 2024

Some of the froth was taken out of stock prices during April’s pullback after allocations to stocks had grown unchecked as the S&P 500 rallied 23% in the October through March time frame. When viewed through a longer-term lens, the S&P 500’s 4% monthly decline appears to be little more than a garden variety correction that should prove healthy, as investor sentiment and expectations were recalibrated to varying degrees. Sentiment shifting from decidedly bullish in the first quarter to neutral in April could lay the groundwork for another move higher in the coming months as upside catalysts for stocks are often more powerful when enthusiasm is tempered than when everyone is already carrying overweight allocations as they were at the end of March. After April’s sentiment shake out, stocks are on stronger footing entering May as healthy skepticism and discernment have returned, a welcome development.

At the end of December, Fed funds futures were pricing in 175 basis points of cuts to the Fed funds rate during 2024, but after a series of hotter than expected inflation prints to begin the year, the futures market view has shifted meaningfully and now the FOMC is expected to cut the funds rate by just 25- to 50-basis points in 2024. With some signs labor costs are cooling evident in the April payrolls report and gasoline prices falling as tensions in the Middle East eased in the back-half of April, inflationary pressures could shift in a more desirable direction for policymakers. To be clear, our constructive outlook on stocks over the balance of this year isn’t dependent upon the FOMC cutting rates, but less restrictive monetary policy would certainly be a welcome kicker under the right economic circumstances. The FOMC cutting because it can, not because it must due to something breaking in the economy would likely boost consumer confidence and investor sentiment pushing stock prices higher still.

On the heels of the FOMC’s meeting in early May, both stocks and bonds rallied as Chair Jerome Powell talked down the possibility of the Committee’s next move being a hike, but what really provided a jolt for the bulls was the FOMC’s decision to taper the pace of balance sheet runoff, or quantitative tightening. Starting in June, $25B per month of Treasury bonds will be allowed to roll off the Fed’s balance sheet, down from the current pace of $60B per month, which implies that the FOMC will be buying $105B more in U.S. Treasury issuance starting in the third quarter than it otherwise would have. This announcement put significant downward pressure on U.S. Treasury yields as the market interpreted this move as the ‘Fed put’ being alive and well. The Fed’s balance sheet shrinking at a more gradual pace beginning in 3Q24 is a positive from a liquidity perspective, as is the U.S. Treasury’s decision to focus the lion’s share of issuance in short-term bills as opposed to notes or bonds. These two variables combined are expected to boost liquidity on a net basis by between $250B and $300B between now and the end of the third quarter. Improved liquidity should provide another tailwind for bulls leading up to the election.

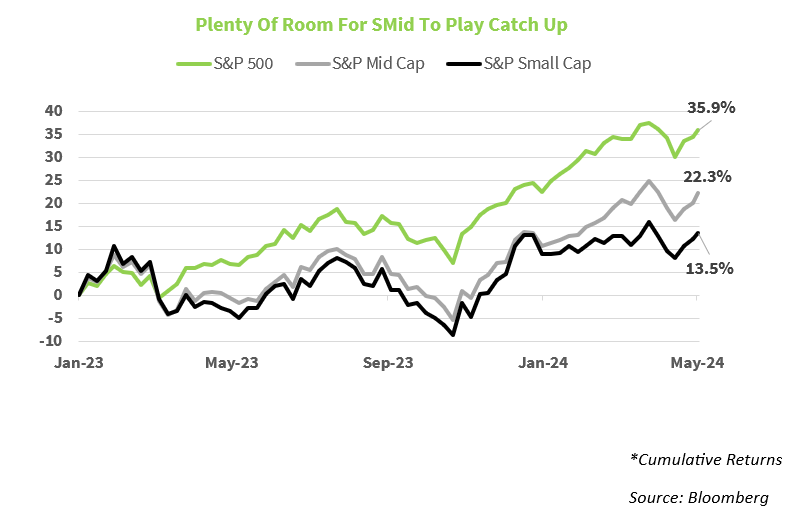

All of the above, combined with a positive seasonal backdrop in the May through July timeframe, could boost investor risk appetite over the coming months, contribute to less volatility in U.S. Treasury yields, and put modest downward pressure on the U.S. dollar. An environment characterized by an improving liquidity backdrop, a cooling, not cracking labor market, and inflation and interest rates falling gradually from elevated levels should lead to improved relative performance out of U.S. small and mid-cap (SMid) stocks. However, we don’t expect the S&P 500 to pass the leadership baton so easily and as a result we maintain neutral allocations to both U.S. large cap and U.S. SMid.

SMid Set To Play Catch Up If Treasury Yields Cooperate. April was the worst month for small caps since last October, with the S&P Small Cap 600 Index registering a 5.6% decline as Treasury yields jumped across the yield curve. Thankfully for investors in smaller capitalization stocks, much of the sharp move higher in yields has reversed in May as the FOMC announced that Treasury securities would run off its balance sheet at a slower pace than expected, a move that could prevent Treasury yields from re-testing October 2023 levels. Falling Treasury yields put a bid under small caps and improved sentiment for the asset class, allowing the segment to gain ground on the S&P 500 early in the new month.

With monetary policy uncertainty contributing to volatility in yields in recent months, investors have viewed small caps as short-term rentals, preventing this cohort of stocks from building enough momentum for a sustainable advance. For a secular rally to take root, interest-rates likely need to stabilize and pressures on profit margins stemming from rising costs tied to goods and labor need to subside. It’s still early, but with 60% of the S&P Small Cap 600 index having reported, quarterly earnings have posted a 7% upside earnings surprise in aggregate, a feather in the cap of downtrodden small cap bulls. Smaller companies have been challenged by higher interest rates and elevated labor costs, but those headwinds appear to be easing to varying degrees, bolstering the case for increased allocations to small and mid-cap (SMid) in equity portfolios. However, the asset class remains prone to shakeouts and sharp reversals, and while we are encouraged by recent price action, we would like to see inflationary pressures trend lower in a more durable manner before increasing exposure to the asset class.

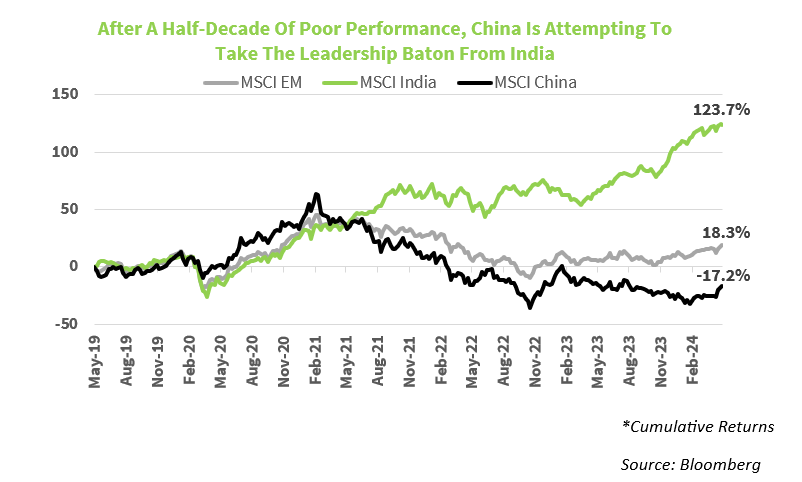

Remain Constructive On Emerging Market Stocks As China Joins The Party. Emerging markets were a notable outlier in April as the MSCI EM index posted a surprising 0.5% gain, despite facing numerous headwinds. Understandably, many country-specific indices fell during the month as energy prices, the U.S. dollar, and Treasury yields moved against developing markets, but China and India, which together account for 44% of the MSCI EM index, were bright spots with the MSCI China index, specifically, turning out a 5.4% gain. China’s resurgence has been a long time coming, and with many portfolio managers carrying underweight allocations relative to their benchmark’s exposure to the country in recent years, just getting back to neutral could drive sizable gains from here. While China’s resurgence is encouraging and cause for optimism on emerging markets broadly, we see other reasons to remain positive on developing markets as we move into the summer months.

Emerging markets have faced powerful headwinds in the form of higher U.S. Treasury yields raising borrowing costs, a stronger U.S. dollar, and rising energy prices in recent months, but the MSCI EM index still closed out April with a 2.8% year-to-date gain. Headwinds should abate over coming quarters with the U.S. dollar weakening over the balance of this year as economic growth abroad picks up, U.S. Treasury yields stabilize as inflation fears subside, and deescalating tensions in the Middle East allow energy prices to moderate. Should even one or two of these headwinds ease, we would expect emerging markets to garner increased interest and capital, driving improved absolute and relative performance.