Bonds: For Now, Credit Risk Still Preferable To Interest Rate Risk

May 2024

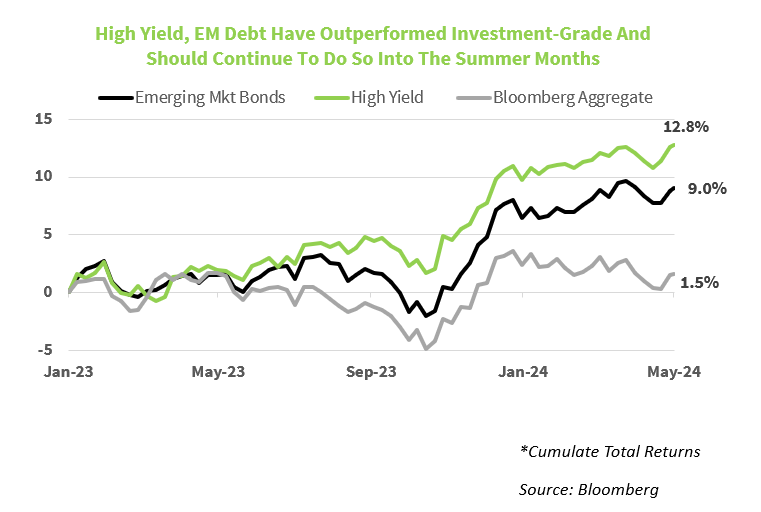

April was a reminder that credit is still king when inflation concerns are top of mind for investors. The Bloomberg U.S. Corporate High Yield index fell by 0.9% during the month, while the investment grade (IG) only Bloomberg Corporate Bond index declined 2.5%, a performance difference driven primarily by the IG corporate index’s greater sensitivity to rising interest rates, known as longer duration. With yields on long-term Treasury bonds moving sharply higher into the back-half of April, both longer duration Treasuries and investment grade corporates were beginning to look more attractively valued/priced as investors were being more appropriately compensated for taking interest rate risk. However, much of that rise in yields has now reversed, and investment grade bonds, broadly speaking, now appear fairly valued again, not relatively cheap versus lower quality credits as they were throughout much of April.

The Bloomberg U.S. Corporate High Yield index boasts a 7.8% yield-to-worst, down modestly from its peak of 8.3% in mid-April, but well below 9.5% reached at the end of last October, and with credit spreads extremely tight relative to historical levels, we can’t characterize high yield as a slam dunk at this point. But given our view that the U.S. economy will remain resilient, and defaults will remain low throughout the balance of this year, it’s not the time to get outright negative and move to an underweight allocation. With that said, lofty valuations for lower quality corporate bonds, along with mixed economic signals on the heels of the 1Q24 GDP release, suggest a selective approach to corporate bonds is increasingly warranted. At some point, our preference for higher yielding corporate credit will shift in favor of higher quality Treasuries and investment-grade corporate bonds, but we’re not there yet and we expect high yield to perform well on a relative basis for a few more months, at a minimum.

Fundamentals Continue To Improve For Emerging Market Debt. As was the case with most fixed income segments last month, emerging market bonds turned out a loss but, the 1.7% decline for the J.P. Morgan Emerging Market Bond Index (EMBI) was below the Bloomberg Aggregate (Agg) Bond Index’s 2.5% decline. April wasn’t the first month in which the EMBI outperformed the Agg as yields moved higher as the Bloomberg Aggregate Bond Index has now posted a negative return in 8 of the last 12-months and the EMBI has outperformed the Agg in all but 2 of those down months. Interestingly, despite the broad nature of the bond sell-off during April, EM debt outperformed due to country-specific fundamental improvements keeping credit spreads tight, partially offsetting the move higher in yields.

From a currency standpoint, April was a tough month as the emerging market currency index fell 0.5% as the U.S. dollar advanced versus most developing market currencies. But as U.S. Treasury yields have moved lower in May, the U.S. dollar has weakened and the EM currency index has already reversed half of April’s drop, we believe there’s likely more room to run for both EM currencies and EM debt in the coming quarters. The case for EM debt isn’t one that is easily made given the volatility profile of the asset class and the lack of confidence in the data flowing out of developing economies. With yields on higher quality bonds in the U.S. low relative to the rate of inflation, investors are being relatively well compensated for these risks via both a higher yield and diversification benefits.

As of May 9, 2024