Knowing the numbers can help you and your family minimize student loan debt.

A college degree is a major investment, and taking on debt to pay for it can affect your financial wellness—and your stress levels—for years after commencement day. Today’s research can help ensure you make more money and potentially have greater career satisfaction in the future.

-

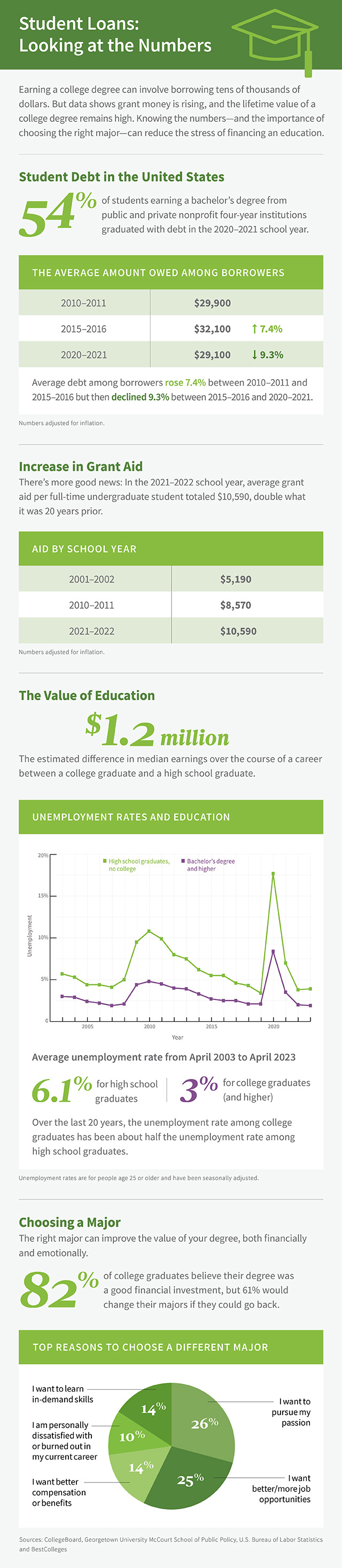

College Borrowing Is Falling

The good and perhaps surprising news is that college borrowing levels are declining. Between 2015–2016 and 2020–2021, the percentage of bachelor’s degree recipients who graduated from public and private four-year schools with debt fell from 60% to 54%. The average amount these graduates borrowed also fell, from $32,100 to $29,100, after adjusting for inflation.

One key reason for lower borrowing levels is that college costs have flattened out over the last decade. Tuition, fees and room and board rose just 2% at public four-year schools between 2012–2013 and 2022–2023 and 6% at private nonprofit schools during that 10-year timespan, after accounting for inflation.

-

Grant Availability Is Rising

Grant growth is also helping to lower borrowing. On an inflation-adjusted basis, grant aid per student is twice what it was 20 years ago—growing from $5,190 per full-time undergraduate student in 2001–2002 to $10,590 in 2021–2022.

But many students don’t take advantage of available aid. A study by the National College Attainment Network estimates that students missed out on as much as $3.6 billion in Pell Grants in 2022 alone. Pell Grants are just one of several types of grants available, suggesting the total grant money that went unused was even higher. It’s also not unusual for scholarships to go unused each year, according to the National Scholarship Providers Association.

Many, but not all, grants are need-based, but some are merit-based, and completing the Free Application for Financial Student Aid (FAFSA) as soon as possible each year gives you the best opportunity to get grant money, which is often awarded on a first-come, first-served basis.

Online research can help identify scholarship sources, but don’t overlook your local library’s reference section, community organizations and professional organizations—especially if you know what you want to study.

-

Investment in College Often Pays Off

By multiple measures, a college degree is a worthwhile investment for most people.

Over the last 20 years, college-degree holders have had a much easier time finding a job than high school graduates. In fact, the unemployment rate for people with at least a bachelor’s degree has consistently been about half that of people with only a high school diploma.

A college degree can also increase lifetime earnings by a substantial amount—$1.2 million, according to one estimate—when compared to a high school diploma. But whether that general finding will apply to any one person, and how much more that person might earn by pursuing higher education, depends on many different factors including major, occupation, industry, location and more.

In fact, 61% of college graduates would change their major if they could go back, in some cases to pursue a life passion, but in many cases to qualify for better job opportunities, pay and benefits. So for many students, it may be worth taking time to explore multiple majors, work part time, shadow professionals, research the outlook for different jobs and work with a career counselor.

These steps can all come with financial costs and offsetting them may require some flexibility. For example, students could attend a local two-year college and then transfer to a four-year university once they’ve gained a clearer picture of their future. Or they could go to an in-state public university rather than a private university but emphasize finding the right major over finishing in four years. Either option could free up funds for career exploration that can prove valuable in the long run.

Three Things to Do

- Get guidance on managing student loan disbursements wisely from Raya Reaves, Founder and Finance Coach at City Girl Savings.

- Read about how to live and have fun on a college budget.

- Listen to a podcast on how to create a financial plan for college.