A comprehensive guide to creating generational wealth, improving your family’s money mindset, growing your legacy, and ensuring it’s maintained for generations to come.

Sometimes referred to as family wealth, generational wealth commonly refers to financial assets that are passed down between generations such as cash, real estate, stocks, life insurance, or a family business.

While the term might conjure up thoughts of trust funds and immense privilege, the true definition of generational wealth encompasses far more than just tangible assets. “It's creating and leaving a legacy that provides for your children, not just about passing on a lump sum of money,” explains Rachel Tatum, Financial Advisor at Regions Bank.

Whether you’re starting with $1 million or $1,000, creating generational wealth is an achievable goal, but one that will require a careful plan that’s tailored to both your goals and your unique financial situation.

- For families of means and high-income households: Generational wealth may be easier to build, but more difficult to maintain. Careful estate planning and thoughtful conversations about money will be essential to ensuring your legacy withstands the next generation.

- If you’re just starting out or have less expendable income: While creating generational wealth can be more of a challenge for the average American family, the right strategy can help make that dream a reality at any income level. Careful planning and know-how will be key to helping you create a lasting legacy.

In this article, we’ll discuss:

- How to create generational wealth

- Strategies for maintaining generational wealth

- Tips for establishing a positive money mindset

- How to raise financially confident kids

How to Build Generational Wealth

When it comes to creating generational wealth, one of the most common misconceptions is that it’s simply not feasible for the average American. “It’s very feasible. Anyone can create generational wealth,” assures Tatum.

Regardless of whether you’re just starting out or are well on your way to achieving your goals, the key is to start with a strong financial plan. As you create your plan for building generational wealth, consider the following tips.

Balance debt vs. savings

Your plan should go one step further than a standard household budget, focusing on strategies that allow you to pay down debt while increasing your savings. Tatum advises her clients to incorporate their retirement savings as a line item in their budget. “Whatever is left over can then be used for other goals, such as college savings or investing,” she explains.

Leverage the power of compound interest

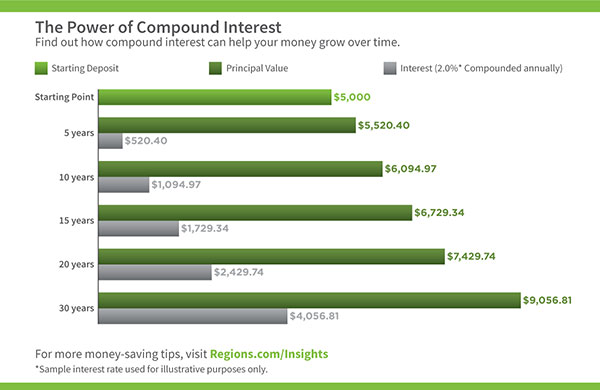

For many, knowing how to start investing can be a challenge. As a financial advisor, Tatum sees many clients struggle to overcome the idea that they don’t have enough money to invest. “Everybody has to start somewhere. There's not a dollar amount that dictates whether you should or shouldn't invest,” she explains. “You can start with as little as $50 a month, and it will grow over time thanks to compound interest.”

Invest in life insurance

Life insurance can be used for much more than simply covering your final expenses. Whole life insurance pays a benefit upon the death of the insured while also accumulating cash value, serving as a form of inheritance.

Open a 529 Plan

Given the long-term impact of student loan debt, opening a 529 Plan and saving for your child’s education can be an effective way to support their financial future. “If your child is able to come out of college without any student loans, that’s significant. They can start saving for their first house, or they can start saving for retirement at a very early age,” says Tatum.

As you grow, grow your wealth

“As you get raises, increase your retirement contribution. If it's money that you weren't seeing before, you can be OK with not seeing it. Increase that savings as time goes on,” Tatum advises.

For more tips on how to build generational wealth at any income level, listen to episode 37 of Regions Wealth Podcast: Building Generational Wealth: How to Create a Financial Legacy.

Maintaining Generational Wealth

For families of means, generational wealth is often easier to grow, but it’s often more difficult to maintain. In fact, studies show that 70% of families lose their wealth by the second generation, and 90% lose it by the third generation.

“The first generation is the one that makes the money, the second generation is the one that spends it, and the third generation often sees none of that money,” explains Paige Christenberry, Wealth Advisor in Knoxville, TN.

Careful planning, thoughtful conversations, and strategic guidance will be essential to ensuring your legacy withstands the next generation. For many families, working with a wealth advisor will be a valuable first step.

“As wealth advisors, we bring in other members of our team to offer advice and guidance on aspects of your estate plan, such as a portfolio manager who manages the actual assets under investment, and a wealth strategist who can come in and create a plan of action. We also work with our clients’ individual estate planning attorneys, and CPAs,” explains Christenberry. “We act as the quarterback of these relationships.”

Safeguard your legacy

Careful estate planning can help ensure that when you transfer your wealth to the next generation, it's done so in the best way possible. For those who aren’t confident in their children’s ability to carefully manage their inheritance, there are a variety of estate planning strategies that can be used to ensure your legacy is maintained. “There are very creative ways to structure a trust. It's a good way to ensure your family is carrying on your legacy after your passing,” explains Christenberry. Depending on the complexity of your estate, you might also consider appointing a professional executor, particularly if you’re concerned about your heirs’ ability to manage your assets.

Have a positive money mindset

Both Christenberry and Tatum note that one of the most common mistakes people make is failing to talk to their children or grandchildren about money. “Having these discussions, regardless of income level, is critical to maintaining your family’s wealth over time,” explains Christenberry. “You have to be open with your family about assets and intentions. We don't do our families any favors by being secretive and closed off.”

The following actions can help ensure your children or grandchildren are well-prepared to maintain your legacy:

- Involve your family in wealth planning or financial planning discussions

- Document your estate plans and discuss your wishes

- Have frequent discussions about your family’s mindset and values

“Your kids don’t have to know everything about your personal finances, but when you get them involved, they won’t feel like it's something hidden or secretive,” Christenberry explains. “When you involve your family, you're letting them know that you trust them.”

For more tactical tips and insights from Christenberry, listen to episode 38 of Regions Wealth Podcast: Maintaining Generational Wealth: How to Protect and Grow Your Legacy.

How to Raise Financially Confident Kids

Financial education is an important, yet commonly overlooked component of generational wealth. “By educating your kids on how to plan and save, you're investing in them so that they can become financially fit whenever they grow up,” Tatum explains.

The following tactics can help you instill the right financial mindset into your kids or grandkids, ensuring they’re well-equipped to maintain your family’s legacy:

- Discuss the value of a dollar. One tactic Christenberry uses with her children is to equate purchases with everyday items, like groceries. “When my son goes to buy a video game, I say, ‘What else could you get for this $50? How many loaves of bread could you purchase?’" she explains.

- Save, share, spend. Your kids are never too young to learn how to budget. Discover tips for teaching kids how to manage money.

- Get them invested. “It's important to show your kids what it means to invest and how it benefits them over time,” says Tatum. “I have a lot of clients in their twenties that are afraid of investing because they've never had any experience in it.”

Ultimately, ensuring your children have a positive money mindset is one of the best ways to set them up for lifelong financial success. “If you're helping your child, educating them at an early age and saving for them at an early age, it's not just giving them a silver spoon,” Tatum notes. “It's building their knowledge on how to save, how to budget, and how to grow their own wealth.”

Key Takeaways:

- Work with an advisor to create financial plan that you can stick to

- Re-evaluate and adjust your plan annually, or as life circumstances change

- Engage in careful estate planning and actively discuss your wishes

- Teach your children how to save, invest, and plan for the future

- Talk to your family about money and involve them in wealth planning discussions

For more tips on creating, growing, and maintaining wealth, check out Regions Wealth Podcast or connect with a Regions Wealth Advisor to begin creating your legacy.