A child’s college graduation used to spell financial relief for many parents.

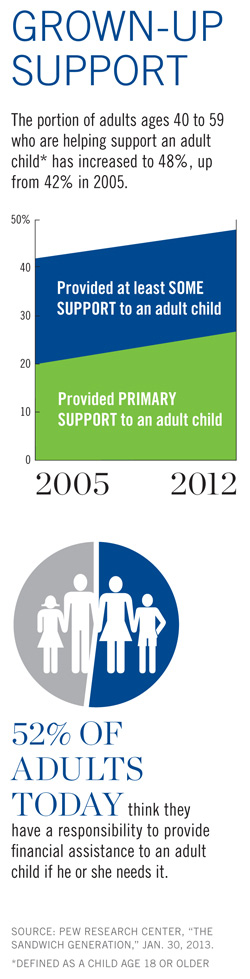

That’s not so true anymore. The turbulent economy and job market of recent years have left young and middle-aged adults today struggling to make ends meet. As a result, they often lean on their parents for financial assistance and other support in their post-college years.

“This has become a significant issue for many baby-boomer parents,” says Missy Epperson, a Regions Private Wealth Management Area Executive based in Baton Rouge, La. “Without a little tough love upfront, parents may find it difficult to stop financially supporting their kids later on. Eventually it can become a burden on their own financial security.”

Epperson recommends that parents spend time in advance determining exactly how much support they can realistically provide an adult child in need. Few want to deny help to a responsible son or daughter facing a true hardship, such as a layoff, difficult job search or health emergency. At the same time, parents must be careful not to jeopardize their own financial security. The goal, Epperson says, should be to ensure their grown children someday become financially self-sufficient. “Once parents start providing support, it’s often hard to exit that situation gracefully,” she adds.

Setting Boundaries

Setting Boundaries

Before providing financial support to a grown child, parents should determine the amount of support to give and the time period over which it will be provided. Spouses don’t always agree, so it’s important they talk through these issues before discussing them with their child. Asking the child for a budget listing how much he or she spends on monthly expenses can help guide the conversation and decision making. Parents may get frustrated if they feel their adult child spends too much on lifestyle expenses such as vacations or restaurant meals, Epperson says. She adds that even though the children are adults, parents providing financial support should feel free to express their concerns about the child’s spending habits. Talking up-front about how the money should be used, and for how long, can help manage expectations and hopefully avoid misunderstandings later on.

Parents may also want to require that their adult child meet certain criteria while receiving financial support, such as actively looking for work or holding a part-time job. One strategy Epperson recommends is that parents slowly reduce the amount of financial support they give to an adult child over time, gradually easing him or her off that financial cushion. Once parents and their adult child come to agreement on how much support will be provided, they may want to put it in writing. This helps ensure everyone is on the same page about the arrangement.

Finding Support

Parents may choose to support their children in various ways. Some may give their child a cash allowance, while others may prefer to cover specific expenses, such as rent or graduate school tuition. Financial gifts to adult children are subject to the $14,000 annual gift-tax exclusion, meaning two parents can give up to $28,000 a year to each child without gift-tax consequences. Direct payments to educational and medical institutions can often be made without gift-tax limits. Certain types of trusts may also help parents provide for their adult. But providing non-financial support can come with its own complications, Epperson warns. “It can be a slippery slope,” she says. “Grandma starts out watching the grandkids a few days a week and suddenly it’s all the time, and it’s affecting her own retirement plans.”

Closing the Spigot

Unfortunately, many parents discover too late the burdens that can accompany supporting their adult children. They may want to clearly express to their child how providing financial or other types of support has affected their own financial security or lifestyle, Epperson says. Explaining this may help the child better understand the reason that financial support will need to end.

Even if parents have the resources to continue assisting an adult child, they may feel that help is undermining the child’s financial independence or is being used to fund activities they didn’t intend to support. Deciding to end assistance can be a gut-wrenching call. But it also may be the step that steers the child to financial self-sufficiency.