Bonds: Yields Rising Even As ‘Hawkish’ Rhetoric Ramps Up

April 2024

On the heels of the Federal Open Market Committee’s (FOMC) March meeting, an absence of hawkish rhetoric and Chair Jerome Powell’s post-meeting comment that it would likely be appropriate to begin easing policy soon were taken by the market as confirmation that the Committee was leaning toward easing monetary policy relatively soon, perhaps even if upcoming inflation data in isolation might not support such a move. The bond market initially rallied on Chair Powell’s post-meeting comments and the Committee’s apparent comfort with the inflationary backdrop and its confidence that inflation would continue to trend lower toward its 2% target, even if at a painfully slow pace. However, with many economic data releases from March continuing to point toward a strong and resilient U.S. economy, market participants appear to view the FOMC’s outlook for the path forward for inflation as overly optimistic and are pushing back by demanding higher yields on long-term Treasuries as a result.

Yields on U.S. Treasuries rose over the back-half of March and into April as market participants appeared less confident in their belief that the FOMC has inflation and the narrative surrounding it under control. Fed funds futures have since shifted and expect between two and three 25-basis point rate cuts in ’24, down from three to four when the FOMC meeting concluded on March 20. The market has moved closer to the FOMC of late, if inflation readings stall out in the coming months or reaccelerate, even two to three cuts this calendar year might prove to be too aggressive.

FOMC speakers have presented a united and more hawkish front when speaking publicly of late, but market participants are concerned about dissention within the FOMC’s ranks potentially leading to greater uncertainty surrounding the path forward for monetary policy. With the U.S. economy strong and inflation remaining sticky, downside for Treasury yields appears limited and risks appear skewed to the upside for rates, leading us to temper our expectations for core investment-grade fixed income over the near-term. Most segments of the fixed income market appear far from cheap, but so long as the U.S. economy holds up, investors will remain emboldened to take risk and reach for yield, benefitting credit sensitive sectors at the expense of lower yielding higher quality bonds such as Treasuries.

The ‘Rich’ Can Still Get ‘Richer.’ It’s been a decent start to the year outside of core investment-grade fixed income as high yield and emerging market debt closed out March with gains. Both segments were two of our preferred areas to deploy capital at the start of this year and, even after a solid start to the year, we remain constructive on these areas over the balance of 2024. The Bloomberg U.S. High Yield index turned out a 1.4% gain during the first quarter but still yields 7.6% after an impressive 11% trailing 12-month return, a figure difficult to find elsewhere, and while defaults are expected to rise at a modest pace over coming quarters, this yield appears ‘safe’ to us given our view that U.S. economic growth will likely remain resilient, boosting corporate profits. Also, with a duration of just 3 years, high yield should be relatively insulated should inflationary pressures remain sticky or reaccelerate from here, forcing Treasury yields higher in the coming months.

Higher yielding, lower quality credits could garner inflows even if interest rate volatility persists so long as U.S. economic growth remains resilient, but it is essential to consider what could discourage additional dollars from flowing into riskier bonds. From our vantage point, inflationary pressures reversing course and moving higher in a sustained manner could prompt a more cautious stance. Under this scenario, policymakers could have limited appetite/ability to come to the rescue and combat any market-related stress as tamping down inflation would be the priority. While this scenario could play out, fundamentals still take precedent, and credit conditions remain benign and are supportive of further, albeit more modest spread tightening.

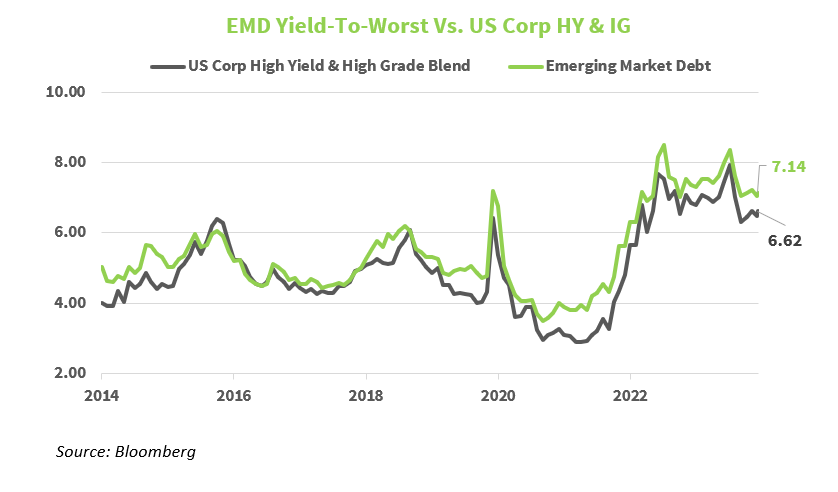

The combined benefit of higher yields and tighter credit spreads buoyed the J.P. Morgan Emerging Market Bond Index (EMBI), leading to a 1.5% year-to-date return through March. High starting yields coming into the year led us to conclude that positive returns for EM debt should be easier to come by going forward, but improved credit profiles for some of the most suspect nations in the EM index have exceeded even the optimistic forecasts thus far. High yield country issuers at the aggregate level saw credit spreads tighten from 600 basis points at year-end 2023 to just 530 basis points at the end of March, evidence that investors require a lower risk premium as some EM issuers undertake fiscal austerity measures supportive of paying down existing debt. Despite the resurgence in developing debt fundamentals, investors still appear under allocated with EM sovereign credit ETFs registering outflows in four of the prior six months. Demand could turn a corner as the FOMC begins cutting rates, as the U.S. dollar could weaken, and investors seek higher yielding alternatives outside of short-term cash-like instruments. Emerging market credit spreads have tightened in recent months due to improved fundamentals which should encourage investors to kick the tires rather than avoid them, especially if the macro backdrop continues to improve. When comparing EM debt against domestic proxies of similarly rated credits, we think the premium for holding EM debt is still high enough to attract investors.

As of April 9, 2024